Introduction

The security code on a debit card, commonly referred to as the CVC (Card Verification Code) or CVV (Card Verification Value), is an essential element for safeguarding your financial transactions. Despite its small size, this three-digit code plays a huge role in ensuring the security of your online and remote purchases. Let’s dive into where you can find it, how it works, and why it’s so important.

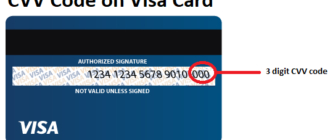

Where Is the Security Code Located?

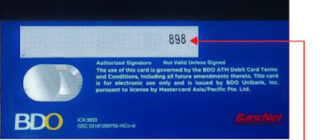

The CVC or CVV code is located on the back of your debit card, typically next to or near the magnetic stripe and the signature panel. It is discreetly printed in small, bold digits to minimize visibility to others. While it may be easy to overlook, this code acts as a gatekeeper for your online transactions.

How to Use the Security Code?

When making online purchases or payments, you will be asked to enter the card number, expiration date, and the CVC/CVV code. Think of this code as a final verification step that ensures you physically have the card in your possession.

- Online Shopping: During checkout, enter the CVC/CVV code in the designated field to authorize the payment.

- Mobile Payments: Many apps require the security code for setting up your card, ensuring that you are the rightful owner.

This additional layer of security significantly reduces the risk of unauthorized transactions, making it harder for fraudsters to misuse your card information.

What to Do If You Forget or Lose It?

If you can’t recall the CVC/CVV code:

- Check Your Card: Flip it over, and you’ll find the code near the signature strip.

- Contact Your Bank: If the code has been damaged or the card lost, call your bank immediately. They may reissue the card to ensure your account remains secure.

⚠️ Important: Never store your CVC/CVV code in easily accessible places, such as your phone notes or visible areas, as it could be exploited if your device or card falls into the wrong hands.

Funny Tales from Real Life

- Marina’s Mishap: Marina always forgot her security code when shopping online. Each time, she called her bank to recover it, causing delays in her purchases. One day, while trying to buy a concert ticket that was about to sell out, she had to endure a 20-minute wait on the bank’s helpline. The tickets were gone, but she now vows to remember her code!

- Andrey’s Emergency: Andrey left his debit card at home when he urgently needed to pay a utility bill online. He realized he didn’t know his CVC code by heart. After a frantic call to his bank, he learned the hard way to keep a virtual card for emergencies.

Why Is the Security Code So Important?

- Fraud Prevention: The CVC code ensures that transactions are made by someone who physically possesses the card, adding a critical layer of protection.

- Secure Online Shopping: The CVC is required for most online transactions, keeping your financial information safe from unauthorized access.

- Global Standard: Accepted across various platforms worldwide, this small code offers universal protection for your card.

Recommendations for Using Your CVC Code Safely

- Memorize Your Code: Avoid writing it down or saving it in unsecured locations.

- Use Virtual Cards: For added security, use virtual cards with temporary CVC codes for online purchases.

- Monitor Transactions Regularly: Regularly review your bank statements to identify and report suspicious activity.

- Avoid Sharing the Code: Never share your CVC code, even with people claiming to be bank representatives.

- Secure Your Card: Keep your physical debit card in a safe place to minimize the risk of loss or theft.

Conclusion

The CVC/CVV code on your debit card may seem like a minor detail, but it serves as a powerful tool for protecting your financial data. By understanding its purpose and handling it responsibly, you can shield yourself from potential fraud and shop online with confidence.

Remember, security starts with you. Treat your card and its security code as valuable assets, and take simple steps to keep them safe. With the right precautions, your financial transactions will remain secure and worry-free!