Introduction

In the age of digital payments, online transactions have become an essential part of our daily activities. From shopping to bill payments, conducting transactions online offers unmatched convenience. However, with this convenience comes the need for enhanced security to protect sensitive financial data. One such security measure implemented by banks and payment systems is the CVC (Card Verification Code), which is prominently used on American Express cards to safeguard your online purchases.

What is a CVC Code?

The CVC (Card Verification Code) is a three-digit number found on the back of most credit and debit cards, including American Express cards. This unique code plays a vital role in verifying the authenticity of the cardholder during online and card-not-present transactions. Unlike other card details such as the card number or expiration date, the CVC code is not stored in the card’s magnetic stripe or chip, making it a valuable tool for reducing fraud in digital transactions.

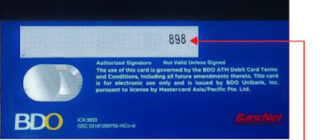

CVC Code Location on American Express Cards

On American Express cards, the CVC code is a three-digit number located on the back of the card, typically to the right of the signature strip. This CVC code can be easily identified and is required during online purchases as an additional measure of verification. American Express also distinguishes its CVC code with its unique placement compared to other card types, helping to maintain consistency and security.

Purpose of Using a CVC Code

The primary purpose of the CVC code is to prevent unauthorized transactions and protect against card fraud, especially in situations where the card is not physically presented. Here’s how the CVC code works:

- Verification of Card Ownership:

When making an online payment, merchants will prompt you to enter the CVC code as part of the purchase process. This helps verify that the cardholder is indeed the one initiating the transaction, thus preventing unauthorized use of a stolen or replicated card. - Fraud Protection:

The CVC code significantly reduces the risk of fraud by ensuring that only the person who possesses the physical card can complete online transactions, even if the card number and expiration date have been compromised. - Added Layer of Security:

By requiring the CVC code for online transactions, the level of security is increased beyond the card number and expiration date, providing customers with a sense of confidence while shopping on the internet.

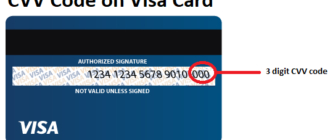

The Difference Between CVC and CVV

While both CVC (Card Verification Code) and CVV (Card Verification Value) are security codes that serve the same purpose, there is a slight difference in terminology based on the payment network:

- CVC (Card Verification Code) is primarily used on American Express cards.

- CVV (Card Verification Value) is commonly used by Visa, Mastercard, and Discover cards.

Despite the difference in naming conventions, both CVC and CVV are three-digit codes that fulfill the same function of verifying the cardholder’s identity and protecting against unauthorized transactions.

Security Measures When Using the CVC Code

To ensure maximum security for your financial data, consider adopting the following best practices when using your CVC code:

- Never Share Your CVC Code:

- Do not share your CVC over the phone or via email, even if the request seems legitimate. Authentic merchants will never ask for your CVC in such ways.

- Enter the Code Securely:

- Always enter your CVC code directly when making online purchases. Be sure the website is secure (look for “https://” in the URL and a padlock symbol in your browser).

- Regularly Check Your Transactions:

- Periodically review your account statements to monitor for any suspicious activity. If you notice unfamiliar charges, report them to your bank immediately.

- Utilize Additional Security Features:

- Enable two-factor authentication (2FA) for online transactions where available, as an added layer of security to further safeguard your account from unauthorized use.

Conclusion

The CVC code on American Express cards is an essential component of securing online transactions, providing an extra layer of verification to ensure that only the authorized cardholder can make payments. By following best practices such as never sharing your CVC code and staying vigilant about your financial activity, you can significantly reduce the risks of fraud and ensure that your personal information remains protected.

Additionally, employing security features like two-factor authentication and merchant verification can enhance your protection and provide you with peace of mind when shopping online.

Sources:

By taking these steps, you can enjoy a safer and more secure online shopping experience.