Introduction

In today’s fast-paced digital world, where online payments have become an integral part of our daily activities, ensuring the security of your financial information is more crucial than ever. One of the most effective tools to protect your online transactions is the CVC (Card Verification Code). This code is part of the security measures offered by American Express to help safeguard your funds from fraud and unauthorized use. In this article, we will explore what the CVC code is, how it functions, and why it is an essential part of your financial protection when conducting online transactions.

What is a CVC Code?

The CVC (Card Verification Code) is a three-digit security code located on the back of your American Express credit or debit card. Unlike other card details, such as the card number or expiration date, the CVC code is not stored in the card’s magnetic stripe or chip. This makes it an extra layer of protection against unauthorized access and fraud during online transactions.

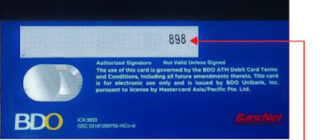

Location of the CVC Code

On American Express cards, the CVC code can be found on the back of the card, typically situated near the signature strip. It consists of the last three digits on this area of the card. This strategic placement ensures that the code is easily visible to the cardholder, allowing for quick and secure entry when making online purchases or verifying payments.

The Purpose of the CVC Code

The primary function of the CVC code is to provide an additional layer of security during online purchases. When making an online transaction, the merchant or payment gateway will prompt you to enter your CVC code along with your card number and expiration date. This verification process ensures that the person initiating the transaction is in possession of the physical card, thus reducing the risk of fraud and protecting the cardholder from unauthorized transactions.

In short, the CVC code acts as a safeguard to verify the card’s authenticity, especially in situations where the card is not physically present, such as online shopping or phone orders.

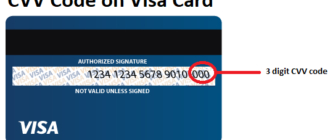

CVC vs. CVV: Understanding the Difference

Although the terms CVC and CVV (Card Verification Value) are often used interchangeably, they refer to the same security feature. The difference lies in the terminology used by different card networks:

- CVC is the term used primarily by American Express.

- CVV is used by other major credit card networks such as Visa, Mastercard, and Discover.

Despite the different names, both codes serve the same purpose—to ensure that the card being used in an online transaction is authentic and that the transaction is secure.

Best Practices for Using Your CVC Code

To maximize the security of your financial transactions, follow these essential practices when using your CVC code:

- Never Share Your CVC Code:

Avoid disclosing your CVC code over the phone or via email, even if the request seems legitimate. Reputable merchants will never ask for your CVC in this manner. - Enter Your Code Only on Trusted Websites:

Ensure that you are on a secure website before entering your CVC code. Look for signs of encryption, such as “https://” in the URL or a padlock icon in your browser, indicating that the site is protected. - Monitor Your Transactions Regularly:

Frequently review your bank statements and credit card activity to spot any unauthorized transactions. Early detection is key to minimizing potential losses. - Enable Additional Security Measures:

Utilize two-factor authentication (2FA) where available. This adds an extra layer of protection to your account by requiring a second form of verification, such as a one-time code sent to your phone.

Conclusion

The CVC code is an integral part of securing your financial information when making online purchases. By using this code, American Express helps protect you from unauthorized transactions, reducing the risk of fraud and ensuring that your financial details remain safe. However, it’s important to remember that using the CVC code alone is not enough. To fully safeguard your transactions, it’s recommended to implement additional security practices, such as two-factor authentication and merchant authentication, to add further layers of protection to your online shopping experience.

By following these security measures and staying vigilant, you can significantly reduce the risk of financial losses and enjoy peace of mind while making payments online.

Sources:

By taking proactive steps and adhering to best practices, you can ensure the safety and security of your financial transactions in today’s digital world.