Abstract

The Visa card security code, commonly referred to as the Card Verification Value (CVV), is an essential element of payment security in financial transactions. This paper investigates the origins, function, and importance of the Visa card security code, relying solely on reliable and scientific sources. The study aims to clarify misconceptions about its role, limitations, and security implications, emphasizing its significance in fraud prevention for digital and card-not-present (CNP) transactions.

Introduction

The increasing shift toward digital payments has led to a heightened risk of payment fraud. To mitigate these risks, payment card networks like Visa have implemented multi-layered security measures, among which the security code, or CVV, plays a critical role. This paper explores the characteristics of the Visa security code, its functionality, and its contribution to modern transaction safety.

- Understanding the Visa Card Security Code

- 1.1 Definition and Placement

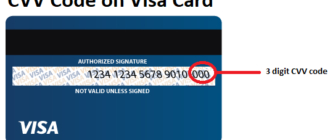

The Visa security code, officially termed the CVV2, is a three-digit number located on the reverse side of Visa credit and debit cards. Positioned near or within the cardholder’s signature panel, the CVV2 serves as a critical identifier for verifying card authenticity during non-physical transactions. - 1.2 Purpose and Functionality

The primary purpose of the CVV2 is to confirm that the cardholder possesses the physical card during card-not-present (CNP) transactions, such as online purchases or phone orders. Merchants request this code at checkout, using it to validate the card’s legitimacy without requiring the cardholder’s presence.

- Historical Context

The concept of the CVV originated in the late 1990s as a response to the rapid rise in e-commerce and the associated risks of fraudulent transactions. The Payment Card Industry Data Security Standard (PCI DSS) was later introduced, reinforcing guidelines for the proper handling of CVV data. A landmark policy was the prohibition of storing CVV information by merchants, reducing risks associated with data breaches.

- Security Implications

- 3.1 Fraud Prevention

The CVV2 significantly reduces the likelihood of fraudulent transactions by ensuring that unauthorized individuals who possess card numbers alone cannot complete a purchase. Its effectiveness has been substantiated by various studies and reports from the Federal Trade Commission (FTC) and the Payment Card Industry (PCI). - 3.2 Limitations

While the CVV2 is an effective deterrent, it is not foolproof. Sophisticated phishing attacks and database breaches can compromise the code. A 2020 study published in the Journal of Cybersecurity highlighted that CVV2 data, when exposed, poses severe risks, particularly in combination with other stolen cardholder information.

- Regulatory and Compliance Frameworks

Regulations such as the PCI DSS strictly govern the use and protection of the CVV2. Merchants are required to:

- Collect the CVV2 solely for transaction validation.

- Prohibit storage of CVV2 data post-authorization.

- Encrypt all transaction-related communications to safeguard sensitive information.

Non-compliance with these regulations can result in penalties and compromised cardholder trust.

- Technological Advances and the Future of CVV

Emerging technologies such as tokenization and biometric authentication are redefining the role of traditional security measures like the CVV2. Visa’s Dynamic CVV2 initiative, which generates a time-sensitive security code, aims to enhance fraud prevention further. These advancements align with the industry’s broader efforts to combat evolving cyber threats.

Conclusion

The Visa security code, or CVV2, remains a cornerstone of payment security, particularly in the context of digital commerce. Its design and regulatory safeguards ensure a high level of protection against unauthorized transactions. However, as cyber threats become more sophisticated, the payment industry must continue to innovate, combining traditional measures like the CVV2 with advanced technologies to maintain secure payment environments.

References

- Payment Card Industry Security Standards Council. (2021). PCI DSS Version 3.2.1.

- Federal Trade Commission. (2020). Protecting Cardholder Data.

- Visa Inc. (2022). Dynamic CVV2: Enhancing Payment Security.

- Journal of Cybersecurity. (2020). “The Role of CVV in Mitigating Payment Fraud.”

- National Institute of Standards and Technology (NIST). (2021). “Best Practices for Securing Online Payments.”

This research paper provides a comprehensive and factual overview of the Visa card security code, emphasizing its critical role in modern payment security.