Introduction

CVC (Card Verification Code) is a three-digit code printed on the back of your credit or debit card. It plays a crucial role in ensuring the security of financial transactions and preventing fraud. In this article, we’ll explore what CVC is, how it works, and why it’s so important.

What is CVC?

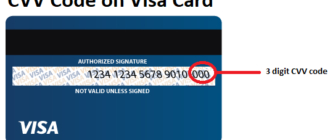

CVC is a three-digit code used to verify the authenticity of a credit or debit card. It provides an additional layer of security, ensuring that the person using the card has physical possession of it. This simple yet effective feature helps protect your funds from unauthorized access.

Where to Find CVC

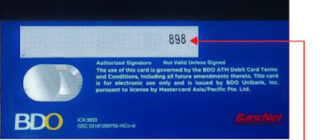

The CVC is located on the back of your card, near the signature panel. It’s printed in a designated area, ensuring it is easy to read but difficult to accidentally erase or damage. On some cards, like American Express, the equivalent code may appear on the front.

How Does CVC Work?

When you make a purchase or transaction, the merchant or website may request your CVC. Here’s how it works:

- You provide the CVC along with your card number and expiration date.

- The bank or payment processor validates the CVC to ensure the transaction is legitimate.

- Without the correct CVC, the transaction will not proceed, even if other card details are correct.

Examples of CVC Use

- In-Store Purchase: A merchant may ask for the CVC to confirm the card’s authenticity and ensure it hasn’t been stolen or counterfeited.

- Online Shopping: Websites often require the CVC to complete a purchase, adding an extra layer of security against fraudulent activities.

- Cash Withdrawals: ATMs might request the CVC for identity verification, preventing unauthorized cash withdrawals.

The Importance of CVC for Security

CVC codes are a vital part of the financial system’s defense against fraud. They:

- Prevent unauthorized use of stolen or counterfeit cards.

- Add an extra step to protect your funds during transactions.

- Ensure that the cardholder is physically present during the transaction process.

Frequently Asked Questions

- What should I do if I lose my card?

- Immediately block your card and notify your bank. Never share your CVC with anyone.

- Can I recover my CVC?

- No, the CVC cannot be recovered. If you lose your card or forget the CVC, you will need a new card.

- How do I protect my CVC?

- Keep your card in a secure place. Avoid sharing your CVC or using it on untrusted websites. Regularly monitor your account for suspicious activity.

Conclusion

The CVC code is a powerful tool in preventing fraud and safeguarding financial transactions. By understanding its importance and proper use, you can protect your funds and ensure secure payments. Stay vigilant and cautious when making purchases or withdrawing cash, and always prioritize the security of your card details.

Call to Action

Check your credit or debit card for its CVC and ensure you know how to use it responsibly. Being informed and cautious is key to protecting your financial well-being.

Visual Enhancements

To enhance the article, include illustrations such as:

- Highlighted Card Example: Show a credit or debit card with the CVC code clearly marked.

- Process Diagram: A simple graphic illustrating how the CVC verification process works during a transaction.