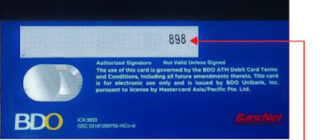

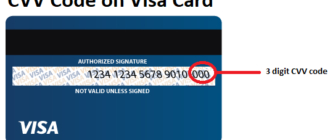

CVC stands for Card Verification Code or Card Verification Value (CVV). It is a security feature for credit and debit cards. Typically, it is a 3-digit or 4-digit code printed on the back (or front, in some cases) of payment cards. It serves as an additional layer of protection to verify that the card is in the possession of the cardholder during a transaction, especially for online or card-not-present purchases.

Origin and History of CVC

The concept of the CVC was introduced in the mid-1990s as the use of payment cards expanded globally, particularly for online and remote transactions. Fraud was increasing significantly as card payments moved away from traditional face-to-face transactions, where signatures and physical presence were required.

Key Milestones:

- Initial Implementation by Mastercard (1997): Mastercard was one of the first major card networks to introduce the CVC, calling it the CVC1. This initial version was embedded in the card’s magnetic stripe, making it available only for in-person transactions.

- CVC2 for Card-Not-Present Transactions (1999): Mastercard expanded the concept to include the CVC2, a visible code printed on the card. This was designed for situations where the card’s magnetic stripe could not be used, such as online or phone orders.

- Adoption by Other Card Networks:

- Visa implemented a similar system called CVV2.

- American Express uses a CID (Card Identification Number), which is a 4-digit code on the front of their cards.

- Discover and other networks later adopted similar security measures.

Why is it Called “CVC”?

The term Card Verification Code reflects its purpose: to verify the legitimacy of a card during transactions. It emphasizes its role as a security measure rather than a transactional detail.

- Verification: It confirms that the card is present or valid at the time of the transaction.

- Code: A unique, non-replicable identifier distinct from the card number or expiration date.

Different card networks use varying terminology for the same concept, but the idea remains consistent.

Importance of CVC

The introduction of the CVC has played a critical role in:

- Reducing Card-Not-Present Fraud: By requiring the CVC for online or phone orders, merchants can add an extra check against unauthorized use.

- Streamlining Transactions: It provides a quick and relatively secure way to verify authenticity without requiring additional hardware or manual checks.

- Supporting Compliance: Many regulations and payment standards (e.g., PCI DSS) require merchants to use CVC verification to enhance security.

Modern Developments

With advancements in technology, the CVC has evolved:

- Dynamic CVCs: Some cards now feature dynamic codes displayed on an electronic screen, which change periodically to reduce static code exploitation.

- Supplementary Methods: Features like 3D Secure (e.g., Verified by Visa, Mastercard SecureCode) complement the CVC by requiring additional authentication layers.

The introduction of the CVC highlights the financial industry’s adaptation to new challenges in security, particularly with the rise of e-commerce.