Introduction

A card security code, commonly referred to as a CVV (Card Verification Value) or CVC (Card Verification Code), is a crucial security feature of credit and debit cards. This three-digit code plays a pivotal role in protecting financial transactions, particularly in card-not-present scenarios, such as online and phone purchases. In this article, we’ll explore the purpose of the card security code, its location, how it works, and essential tips to protect yourself from fraud.

Definition and Purpose

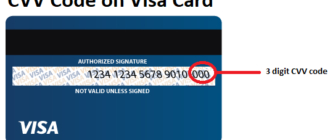

A card security code is a three-digit number located on the back of a credit or debit card. It acts as an additional layer of verification, ensuring that the person initiating the transaction possesses the physical card. This feature is particularly useful for online transactions where the cardholder cannot physically present the card. By requiring the security code, merchants and banks can minimize the risk of fraudulent activities and unauthorized transactions.

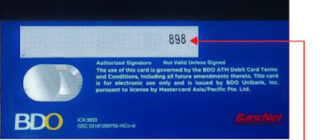

Where to Find the Card Security Code

You can locate the card security code on the back of your bank card. It is usually:

- Printed on the signature strip or just above it.

- Positioned near the cardholder’s signature or the magnetic stripe.

This code is not embossed like the card number and is deliberately excluded from the front of the card to reduce the chances of accidental exposure or copying.

For certain cards, such as American Express, the security code may be a four-digit number located on the front of the card, above the card number.

How to Use the Card Security Code

The card security code is primarily used for transactions where the physical card is not presented, such as:

- Online Purchases:

Many e-commerce platforms require the CVV/CVC code during checkout to verify the cardholder’s identity. - Phone Orders:

When placing an order over the phone, merchants may ask for the CVV to confirm the transaction’s legitimacy. - Recurring Payments:

Subscriptions and recurring payment services often require the CVV during the initial setup to validate the card.

By entering the security code, the cardholder authorizes the transaction, helping merchants and banks verify that the purchase is legitimate and not fraudulent.

How to Protect Your Card Security Code

Since the card security code is a key component of transaction verification, safeguarding it is essential. Follow these precautions to protect your CVV/CVC:

- Keep It Confidential:

Only share your card details on secure, trusted platforms. Never disclose the CVV over phone calls, emails, or text messages. - Monitor Your Card Usage:

Regularly check your bank statements for unauthorized transactions and report suspicious activity immediately. - Obscure the Code:

If you frequently carry your card in places where it might be exposed, consider covering the CVV with a black marker after memorizing it. - Be Vigilant with Online Transactions:

Always use secure websites with “https://” in the URL and avoid public Wi-Fi when making purchases. - Report Lost or Stolen Cards Promptly:

If your card is lost or you suspect it has been compromised, contact your bank immediately to block the card and issue a replacement.

Common Scams Involving the Card Security Code

Fraudsters often employ various tactics to gain access to card security codes. Here are some common scams and tips to avoid them:

- Phishing Websites:

Scammers create fake websites that mimic legitimate online stores to steal your card details.

How to Avoid: Verify the site’s authenticity before entering your card information. Use trusted payment gateways. - Fake Phone Calls:

Fraudsters pose as bank employees or customer service representatives and ask for your CVV.

How to Avoid: Banks never ask for your CVV over the phone. Hang up and contact your bank directly to verify the caller. - Skimming Devices:

Fraudsters use fake payment terminals or skimming devices in restaurants and stores to steal card data.

How to Avoid: Be cautious of unfamiliar or tampered terminals. Always keep an eye on your card during transactions.

Conclusion

The card security code is an essential safeguard for protecting your financial transactions and preventing fraud. By understanding its purpose and following best practices to secure it, you can reduce the risk of unauthorized transactions and maintain control over your financial data.

Remember, vigilance is key. Always double-check the platforms and individuals you share your card details with, and use your CVV responsibly to ensure safe and secure transactions.