In the digital age, where financial transactions are increasingly conducted online, protecting your personal and financial information has never been more critical. One of the essential tools in safeguarding your finances is the Card Code. In this article, we’ll delve into what a Card Code is, how it functions, and why it plays a pivotal role in your financial safety.

What is a Card Code?

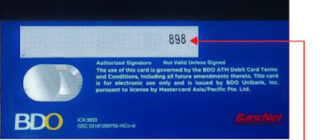

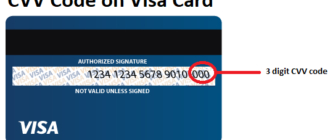

The Card Code is a three- or four-digit numeric code found on your bank card. It is a security feature designed to verify the authenticity of your card during online and phone transactions.

- Location: On most cards, such as Visa, Mastercard, and Discover, the code is a three-digit number located on the back of the card near the signature strip. On American Express cards, it is a four-digit number on the front, above the card number.

- Terminology: The Card Code may be referred to as CVV (Card Verification Value), CVC (Card Verification Code), or CID (Card Identification Code) depending on the payment network.

Why is the Card Code Important?

The Card Code is a vital security measure for protecting your finances, offering several key functions:

- Authentication of Transactions

The Card Code ensures that the person initiating a transaction has physical possession of the card. It acts as an additional layer of verification, particularly for online and phone purchases, where the card cannot be swiped or inserted. - Fraud Prevention

By requiring the Card Code for transactions, financial institutions can prevent unauthorized use of your card. Even if your card number is stolen, a fraudster cannot complete a transaction without the Card Code. - Simplified Digital Payments

Many modern payment systems integrate the Card Code into their security measures. This enables quick and secure payments, enhancing user convenience while maintaining a high level of protection.

How Does the Card Code Work?

When making a purchase or payment:

- Step 1: The merchant requests your card details, including the number, expiration date, and Card Code.

- Step 2: The Card Code is transmitted securely to the payment processor for verification.

- Step 3: If the code matches the bank’s records, the transaction is approved. Otherwise, it is declined to prevent fraud.

The Benefits of Using a Card Code

The inclusion of a Card Code on your payment card provides several significant advantages:

- Enhanced Security

The Card Code is an effective barrier against unauthorized transactions. Even if a fraudster obtains your card number, they cannot use it without the Card Code. - Convenience and Simplicity

The Card Code is straightforward to use—just three or four digits that you can easily enter during transactions. Its simplicity belies its importance in securing your finances. - Real-Time Monitoring

Many banks offer instant notifications for transactions involving the Card Code. This allows you to track and verify your purchases in real time, ensuring complete control over your finances.

Best Practices for Protecting Your Card Code

While the Card Code adds a layer of security, it is still essential to practice caution:

- Do Not Share Your Card Code: Never disclose it to anyone, even if they claim to be from your bank or a legitimate merchant.

- Avoid Public Wi-Fi for Transactions: Public networks are less secure and may expose your financial details.

- Use Secure Websites: Look for “https://” in the website URL before entering your card details.

- Regularly Monitor Statements: Check your bank statements frequently to spot and report suspicious transactions.

- Consider Virtual Cards: Some banks offer virtual cards with unique codes for one-time use, adding an extra layer of protection.

Conclusion

The Card Code is more than just a string of numbers on the back of your bank card—it is a cornerstone of modern financial security. By understanding its purpose and adhering to best practices for its use, you can protect yourself from fraud and unauthorized transactions.

In a world where digital payments are the norm, staying informed about security features like the Card Code is essential for maintaining control over your finances. Always prioritize security, and enjoy the convenience and peace of mind that the Card Code provides.