Hello, friends! 👋 Today, let’s dive into an essential but often overlooked detail in our daily financial transactions: the CVC code. Understanding what it is and how it works can significantly boost your financial security, especially in the digital age. 💰

What is CVC? 🔒

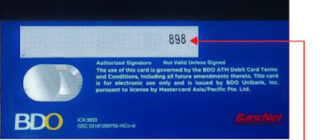

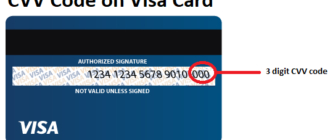

CVC stands for Card Verification Code—a three-digit number printed on the back of your credit or debit card, typically near the signature strip. On American Express cards, this code is a four-digit number displayed on the front of the card.

The CVC acts as a security feature that helps safeguard your financial information during online or over-the-phone transactions. By requiring this code, merchants can confirm that the person initiating the transaction has physical possession of the card, reducing the likelihood of unauthorized use.

Why is CVC Important? 🤔

The CVC code serves as an extra layer of security that protects your funds and personal information. Here’s why it matters:

- Fraud Prevention: Imagine shopping online and the merchant requests your CVC code in addition to your card number. Without the CVC, even if a fraudster obtains your card number, they cannot complete the transaction. This effectively prevents unauthorized purchases.

- Authentication: The CVC confirms that the individual making the transaction is the legitimate cardholder. It acts as a digital signature, adding another checkpoint for verifying your identity.

- Reduced Risk of Data Breaches: Unlike the card number or expiration date, merchants are prohibited from storing your CVC. This ensures that even if a database is compromised, the CVC remains secure.

How to Use and Protect Your CVC 🛡️

Using and safeguarding your CVC is straightforward but crucial. Follow these best practices:

- Keep It Confidential: Never share your CVC with anyone, even if they claim to be from your bank or a trusted organization. No legitimate institution will ask for this code over the phone, email, or text.

- Verify Website Security: Only enter your CVC on trusted websites with “https://” in the URL and a secure payment gateway. Look for security indicators like a padlock symbol in the address bar.

- Avoid Suspicious Platforms: If a website or merchant seems untrustworthy, refrain from providing your CVC. Instead, consider using alternative payment methods like virtual cards or digital wallets.

- Monitor Your Transactions: Regularly review your bank statements and transaction history to spot any unauthorized activity. Promptly report any suspicious transactions to your bank.

- Use Multi-Factor Authentication (MFA): Enable additional security measures such as one-time passwords (OTPs) or biometric verification to add another layer of protection.

CVC: A Small Code with Big Impact 🌐

While the CVC is a small detail, its role in ensuring your financial security cannot be overstated. It’s a key player in the fight against fraud and unauthorized transactions, particularly in online shopping and remote payments.

By understanding what the CVC is, why it’s important, and how to use it responsibly, you can enhance your financial literacy and protect your assets from scammers. Remember: vigilance and caution go hand in hand with technology.

I hope this information has been helpful! Stay safe, stay informed, and take care of your finances. 💳✨

#Finance #Security #CVC #CreditCard #FraudPrevention #FinancialLiteracy