Introduction

In the digital age, online payments have become an essential part of everyday life. To protect these transactions, banks and payment systems have implemented various security measures. One such measure is the CVC (Card Verification Code), a critical feature on American Express cards that ensures the safety of your financial information.

What is a CVC Code?

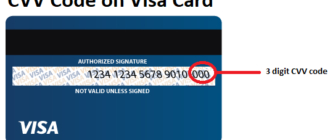

The CVC (Card Verification Code) is a security feature designed to verify that the cardholder is in possession of the card during online transactions. This three-digit code is a key tool in preventing fraud and unauthorized use of your card for online purchases.

Where is the CVC Code Located?

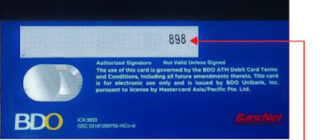

On most credit and debit cards, the CVC code can be found on the back, typically near the magnetic stripe or signature panel. However, on American Express cards, the code is slightly different:

- American Express Cards: The security code, often called a CID (Card Identification Number), is a four-digit number located on the front of the card, above the embossed card number.

Purpose of the CVC Code

The CVC code serves a vital role in enhancing the security of online transactions. When making a purchase, you are required to input this code as part of the verification process. This extra step ensures that only the authorized cardholder can use the card, reducing the risk of fraud and protecting sensitive card data.

Differences Between CVC and CVV

While CVC (Card Verification Code) is a term commonly associated with American Express, Visa, Mastercard, and Discover use a similar security measure called the CVV (Card Verification Value). Although the names differ, the purpose is identical: to provide an additional layer of security for online payments.

- American Express: Four-digit CVC (CID) code on the front.

- Visa/Mastercard/Discover: Three-digit CVV code on the back near the signature panel.

Security Tips for Using the CVC Code

To safeguard your financial information, it’s essential to follow these best practices when using the CVC code:

- Do Not Share the Code: Never disclose your CVC code over the phone, via email, or on untrusted websites.

- Use Secure Platforms: Ensure the website is legitimate and secure (look for HTTPS in the URL) before entering your card details.

- Monitor Transactions: Regularly review your bank statements and credit history to identify any unauthorized activity.

- Enable Additional Security Measures: Use two-factor authentication and merchant verification for added protection.

- Be Vigilant: Avoid saving your card details on public or shared devices.

Conclusion

The CVC code on American Express cards is a vital feature that helps prevent fraud and ensures the security of online transactions. By understanding its purpose and implementing appropriate safety measures, you can protect your financial data effectively.

While the CVC code plays a critical role in securing payments, combining it with other security tools, such as two-factor authentication and monitoring your accounts, will further enhance your protection.

References

By following these guidelines, you can significantly reduce the risk of fraud and ensure a safe and secure online shopping experience.