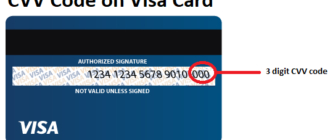

The Card Verification Value (CVV), also known as the Card Security Code (CSC), is a critical security feature in credit and debit card transactions. It was developed in 1995 by Michael Stone, an employee of Equifax in the United Kingdom, to combat the rising incidence of credit card fraud in card-not-present transactions, such as online and phone purchases.

Development and Implementation

Initially, the CVV was an eleven-character alphanumeric code. After testing with the Littlewoods Home Shopping group and NatWest bank, the concept was adopted by the UK Association for Payment Clearing Services (APACS) and streamlined to the three-digit code known today.

Mastercard began issuing cards with the CVV feature in 1997, followed by Visa in the United States by 2001.

This widespread adoption marked a significant advancement in securing electronic transactions.

Impact on Michael Stone’s Career

Michael Stone’s development of the CVV code was a pivotal contribution to payment security. Prior to his role at Equifax, Stone spent a combined 18 years working with two of the world’s largest global credit bureaus, Experian and Equifax, in various roles, including developing credit bureaus in Europe and Asia, data and decision systems, anti-fraud solutions, and global card transaction processing systems. While specific details about his career trajectory following the CVV’s introduction are not widely documented, his work has had a lasting impact on the financial industry, enhancing the security of card transactions worldwide.

Advantages of the CVV

- Enhanced Security: The CVV provides an additional layer of verification, ensuring that the person conducting a transaction possesses the physical card, thereby reducing the risk of unauthorized use.

- Fraud Prevention: By requiring the CVV for online transactions, merchants can verify the authenticity of the card, decreasing the likelihood of fraudulent activities.

- Consumer Confidence: The presence of a CVV code reassures consumers about the safety of their online transactions, encouraging the use of electronic payments.

Disadvantages and Challenges

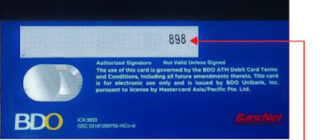

- User Awareness: Initially, some cardholders were unaware of the CVV code’s purpose and location, leading to confusion during online transactions.

- Storage Limitations: Merchants are prohibited from storing CVV codes after transaction authorization, complicating processes like recurring billing where the CVV cannot be reused without re-entry.

- Not Foolproof: While the CVV adds a layer of security, it is not immune to fraud, especially if both the card number and CVV are compromised through phishing or data breaches.

Conclusion

The introduction of the CVV code has been instrumental in enhancing the security of electronic transactions, significantly reducing fraud in card-not-present scenarios. Michael Stone’s innovation has become a standard security measure globally, underscoring the importance of continuous advancements in payment security to protect consumers and merchants alike.