Introduction

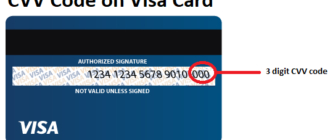

In an era where online payments and digital banking have become integral to daily life, it’s crucial to consider how much children know about financial security features such as the CVC (Card Verification Code). The CVC, a three-digit code on the back of most bank cards, serves as a critical layer of protection for online transactions. This article delves into research and real-world insights to evaluate children’s understanding of the CVC code and highlights the importance of teaching financial literacy from a young age.

Study 1: Children’s Awareness of CVC Codes

A study conducted across multiple schools surveyed children aged 10 to 15 about their understanding of financial concepts. The findings revealed that while the majority of children are familiar with the basic functions of a bank card, their knowledge of specific security features like the CVC code is limited.

- General Awareness: Around 85% of children could identify a bank card and explain its purpose.

- CVC Knowledge: Only 20% could accurately define a CVC code or explain its role in protecting online transactions.

This gap highlights a need for targeted education about the finer details of financial security, especially as children increasingly interact with digital platforms.

Study 2: The Role of Parents and Teachers

Parents and educators play a pivotal role in shaping children’s financial literacy. However, the study found that many adults fail to adequately explain the importance of features like the CVC code:

- Parental Oversight: Many parents admitted to not discussing the CVC code with their children, either because they assumed it wasn’t relevant or because they didn’t fully understand its significance themselves.

- Teacher Involvement: Financial literacy programs in schools often cover budgeting and saving but rarely delve into the specifics of online security, leaving gaps in children’s knowledge about protecting personal data.

These findings underscore the importance of equipping both parents and teachers with the tools to educate children about modern financial security.

Study 3: Online Risks for Children

As children increasingly engage with online platforms for gaming, shopping, and social interaction, their exposure to financial risks grows:

- Unintentional Sharing: Children, unaware of the significance of card details, may inadvertently share sensitive information such as card numbers and CVC codes on unsecured websites or with untrustworthy individuals.

- Fraud Vulnerability: Scammers often target children through games or apps, enticing them to enter card details for “free” rewards or upgrades.

- Lack of Awareness: Many children don’t recognize the warning signs of phishing attempts, such as suspicious links or requests for personal information, making them easy targets for fraud.

Strategies to Improve Children’s Financial Awareness

To address these gaps, parents, educators, and institutions must adopt proactive measures to educate children about financial security:

- Parental Guidance:

- Regularly discuss the purpose and importance of CVC codes and other security features.

- Set boundaries for online spending and supervise transactions.

- School Programs:

- Integrate financial security topics into school curriculums, emphasizing the role of features like CVC codes in online safety.

- Use interactive tools and simulations to teach children how to identify secure websites and avoid phishing scams.

- Collaboration with Financial Institutions:

- Banks can create child-friendly educational resources, such as videos and apps, to explain financial concepts.

- Offer specialized bank accounts for children that include built-in security features and parental controls.

- Technology Use:

- Encourage the use of virtual cards or wallets that limit exposure to card details.

- Enable security alerts for transactions to monitor and safeguard children’s spending habits.

Conclusion

While children today are increasingly familiar with the basics of bank cards, their understanding of security features like the CVC code remains inadequate. This gap is often due to a lack of guidance from parents and educators, coupled with the rising risks in the digital landscape.

Empowering children with knowledge about financial security is essential for protecting them from potential fraud and financial loss. By incorporating financial literacy programs into school curriculums and fostering open discussions at home, we can equip the next generation with the skills needed to navigate the modern financial world safely and responsibly.

Proactive efforts to improve children’s financial awareness will not only safeguard their immediate transactions but also lay the foundation for lifelong financial security.