The Card Security Code (CSC), commonly known as CVV (Card Verification Value) or CVC (Card Verification Code), is a crucial security feature in modern payment systems. This code enhances the security of card-not-present transactions, such as online or phone purchases, by verifying that the customer possesses the physical card.

Location and Format

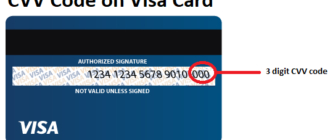

The CSC is a numerical code printed on payment cards:

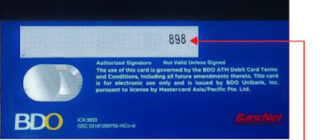

- Visa, Mastercard, Discover, Diners Club, and JCB: A three-digit code located on the back of the card, typically to the right of the signature strip.

- American Express: A four-digit code printed on the front of the card, above the card number.

These codes are printed flat and are not embossed or encoded on the magnetic stripe, ensuring they are only visible on the physical card.

Evolution of the CSC

The concept of the CSC was developed in the UK in 1995 by Equifax employee Michael Stone. Initially, it was an eleven-character alphanumeric code. Over time, the CSC evolved into the shorter numeric codes used today, simplifying their use and verification processes.

Purpose and Importance

The primary function of the CSC is to provide an additional layer of security for card-not-present transactions. By requiring this code, merchants can verify that the customer has physical access to the card, reducing the risk of unauthorized use from stolen card numbers.

Impact of CSC Absence

Without the CSC, payment systems would face increased vulnerabilities:

- Higher Fraud Rates: Fraudsters could more easily use stolen card numbers for unauthorized transactions.

- Decreased Consumer Trust: Frequent fraud incidents could erode consumer confidence in online and phone transactions.

- Increased Merchant Liability: Merchants might face higher chargeback rates and financial losses due to fraudulent transactions.

Complementary Security Measures

In addition to the CSC, several other security measures enhance payment security:

- 3D Secure Protocols: Services like Visa’s Verified by Visa and Mastercard’s SecureCode add an extra authentication step during online transactions.

- Tokenization: This process replaces sensitive card information with a unique identifier or “token,” reducing the risk of data breaches.

- Dynamic CVV/CVC Codes: Some cards feature a dynamic security code that changes periodically, further enhancing security.

These measures work in tandem with the CSC to protect against fraud and ensure secure transactions.

Conclusion

The Card Security Code is a vital component of payment card security, significantly reducing the risk of fraud in card-not-present transactions. Its development and implementation have been instrumental in fostering trust and security in the evolving landscape of digital commerce.